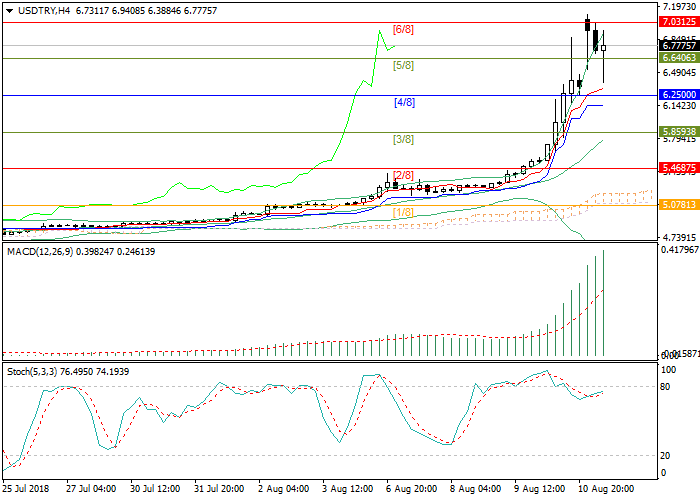

The Turkish lira continues to fall against the US dollar due to the financial crisis in Turkey, connected with the introduction of the US increased duties on imported aluminium and steel from Turkey. As a result, the Turkish lira fell to historic lows. Despite a small downward correction, which was caused by the introduction of limits on foreign exchange operations with foreign counterparties (operations should not exceed 50% of the bank's capital), the tendency to the growth of the USD/TRY rate is still strong, which is confirmed by technical indicators. The Bollinger bands diverge, reflecting the active development of the current upward trend. MACD is growing in the positive zone, forming a buy signal. Stochastics lines are directed upwards.

The next target for long positions will be the level of 7.2941 (Murray [7/8]). This scenario will be possible if the rate consolidates above the level of 7.0312 (Murray [6/8]).

The downward correction will be possible below the level of 6.6400. In this case, the decline will continue to the level of 6.2500 (Murray [4/8]), where a strong support zone is located.