What is your opinion on the EUR/USD in the long term? Are we to further expect an uptrend or down trend in the envisaged future?

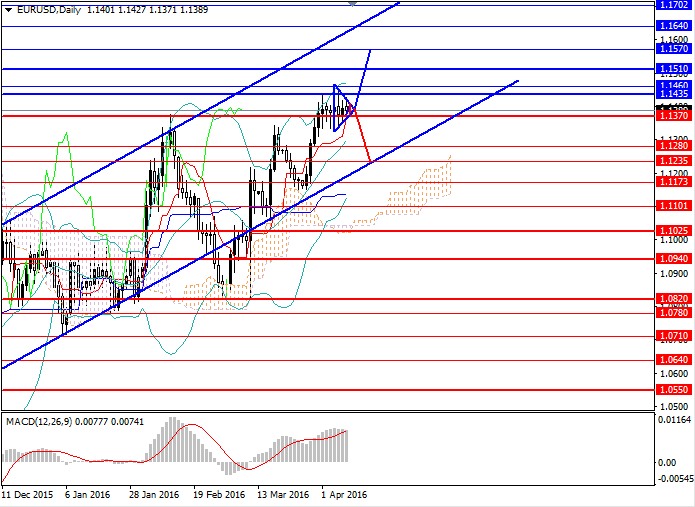

Since the end of March, the EUR/USD pair has been trading sideways. Such dynamics was determined by mixed macroeconomic data, released both in the US and the eurozone.

In the second half of the week, the publication of a series of important indicators can influence future trend in the pair. Market participant will be following data on industrial production and consumer price index, due in the EU, and data on retail sales, inflation and labour market, due the US.

A sideways triangle pattern has formed on the chart, and strong price movement should be expected amid the publication of macroeconomic statistics. Therefore, the price is likely to continue trading sideways for a couple of days and then either grow to the key resistance of 1.1570 or fall to the strong support of 1.1235.