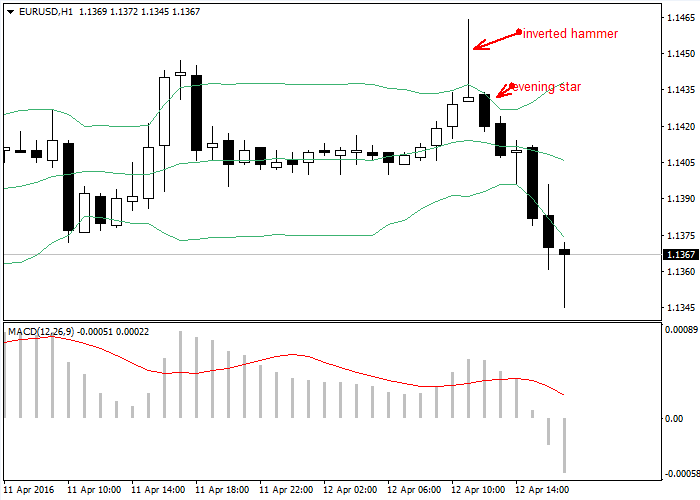

During eur intrest fate decsion if rates unchanged eurusd will go down can i take sell ?

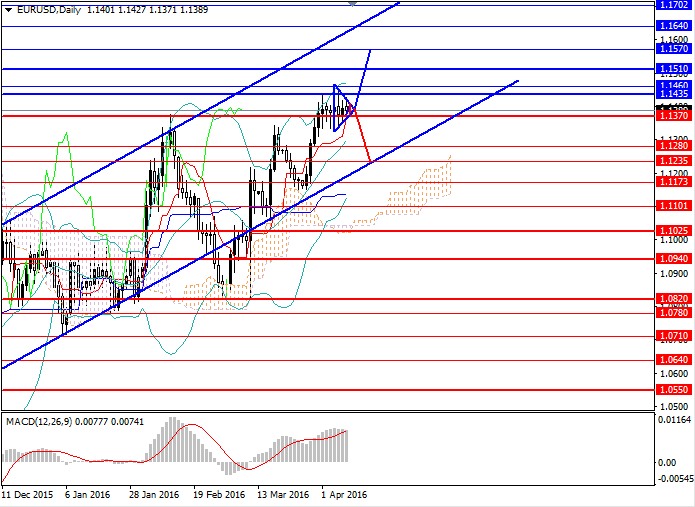

The ECB will probably keep the interest rate unchanged so the decision itself is unlikely to lead to a growth or a fall in the Euro.

Closer attention is paid to ECB President Draghi speech. His comments could lead to an increase in volatility on the market. Markets expect that Draghi will continue with monetary policy easing, and that could pressure the Euro. Otherwise, the Euro could keep growing.

Today attention also should to be paid to data on Initial Jobless Claims in the US, which is due at 2:30 pm (GMT+2).